A New Car Has a Sticker Price of $25,750

Affordability and Financing Options for a $25,750 Vehicle

A new car has a sticker price of 25750 – Purchasing a new car is a significant financial commitment. Understanding the various financing options and their associated costs is crucial for making an informed decision. This section explores different loan terms, the impact of down payments, and alternative financing methods like leasing.

Loan Term, Interest Rate, and Monthly Payment Comparison, A new car has a sticker price of 25750

Source: cloudfront.net

The following table illustrates the monthly payments and total interest paid for a $25,750 car loan with varying loan terms and interest rates. These figures are estimates and do not include taxes, fees, or other potential charges.

| Loan Term (Months) | Interest Rate (%) | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| 36 | 3 | $742 | $1,912 |

| 36 | 5 | $768 | $2,500 |

| 36 | 7 | $795 | $3,060 |

| 48 | 3 | $572 | $2,760 |

| 48 | 5 | $598 | $3,610 |

| 48 | 7 | $626 | $4,500 |

| 60 | 3 | $466 | $3,600 |

| 60 | 5 | $492 | $4,600 |

| 60 | 7 | $520 | $5,600 |

Impact of Down Payment

A down payment significantly reduces the loan amount, leading to lower monthly payments and total interest paid. The following table demonstrates this effect for various down payment percentages.

| Down Payment (%) | Loan Amount | Monthly Payment (48 months, 5% interest, approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| 0 | $25,750 | $598 | $3,610 |

| 10 | $23,175 | $538 | $3,228 |

| 20 | $20,600 | $478 | $2,808 |

Alternative Financing Options

Besides traditional loans, other financing options exist, each with its own set of advantages and disadvantages.

- Leasing: Leasing involves paying for the use of the vehicle for a specific period, typically 2-3 years. Monthly payments are generally lower than loan payments, but you don’t own the car at the end of the lease term. There are often mileage restrictions and penalties for excessive wear and tear.

- Manufacturer Financing: Some car manufacturers offer special financing programs with low interest rates or other incentives. These programs are often tied to specific models or sales events.

- Buy Here, Pay Here Dealerships: These dealerships offer financing directly, often to individuals with poor credit. However, interest rates are typically much higher.

A new car with a sticker price of $25,750 might seem like a good deal, but it’s important to consider the overall market. Checking the average prices from a resource like this website detailing 2022 new car prices can provide valuable context. Understanding the 2022 market helps determine if $25,750 is truly a competitive price for a new car in that model year.

Vehicle Features and Value at the $25,750 Price Point

Several vehicles fall within the $25,750 price range, each offering a unique combination of features and specifications. Careful consideration of these factors is essential to determine the best value for your needs.

Vehicle Comparison

The following table compares three hypothetical vehicles with similar sticker prices, highlighting their key features and specifications. Note that specific models and features may vary depending on trim levels and options.

| Make/Model | Engine | Fuel Efficiency (city/highway, mpg) | Safety Features | Standard Equipment |

|---|---|---|---|---|

| Honda Civic | 1.5L Turbocharged 4-cylinder | 30/40 | Honda Sensing suite (forward collision warning, lane keeping assist, adaptive cruise control), airbags | Apple CarPlay, Android Auto, touchscreen infotainment system |

| Toyota Corolla | 1.8L 4-cylinder | 31/40 | Toyota Safety Sense 2.0 (similar features to Honda Sensing), airbags | Similar infotainment system to Civic |

| Mazda3 | 2.5L 4-cylinder | 28/36 | i-Activsense safety suite (similar features), airbags | Premium interior materials, Mazda Connect infotainment system |

Comparative Analysis of Vehicle Value

Comparing these three vehicles reveals differences in performance, fuel economy, and features. The Honda Civic and Toyota Corolla prioritize fuel efficiency and reliability, while the Mazda3 emphasizes a more premium driving experience and styling.

- Fuel Efficiency: The Honda Civic and Toyota Corolla offer slightly better fuel economy than the Mazda3, potentially resulting in lower long-term fuel costs.

- Performance: The Mazda3’s larger engine offers potentially more spirited performance compared to the Civic and Corolla.

- Technology and Features: All three offer competitive infotainment systems, but the Mazda3 might stand out with its higher-quality interior materials.

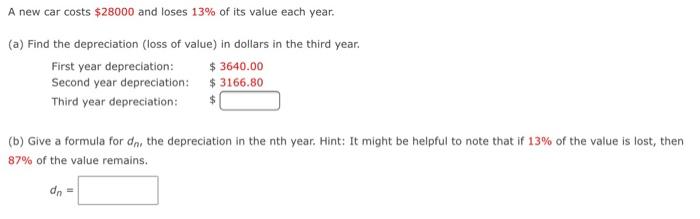

Long-Term Cost Estimation

Source: cheggcdn.com

Long-term ownership costs extend beyond the initial purchase price. Factors like maintenance, insurance, and fuel consumption significantly impact the total cost of ownership. These costs can vary based on driving habits, location, and vehicle type.

- Maintenance: Regular maintenance, including oil changes, tire rotations, and brake replacements, is essential. These costs can vary depending on the vehicle’s complexity and age.

- Insurance: Insurance premiums vary based on factors such as driving record, location, and vehicle type. Vehicles with higher safety ratings often have lower premiums.

- Fuel: Fuel costs are a significant expense, particularly for vehicles with lower fuel efficiency. Gas prices fluctuate, so this cost is subject to change.

Market Research and Comparisons for $25,000 – $30,000 Vehicles: A New Car Has A Sticker Price Of 25750

Understanding the current automotive market is essential when purchasing a new car. This section examines market trends, pricing factors, and compares new and used car options.

Current Automotive Market Landscape

The $25,000-$30,000 price range is highly competitive, with many models from various manufacturers vying for consumer attention. Key market trends include:

- Increased demand for SUVs and crossovers.

- Growing popularity of hybrid and electric vehicles, although these are often priced higher in this segment.

- Ongoing supply chain challenges impacting availability and potentially pricing.

- Competition among manufacturers leading to increased incentives and offers.

Factors Influencing New Car Prices

Several factors influence the price of a new car:

- Manufacturing costs: Raw materials, labor, and manufacturing processes contribute to the base cost of the vehicle.

- Supply chain issues: Disruptions to the supply chain, such as semiconductor shortages, can impact production and increase prices.

- Market demand: High demand for certain models can drive up prices, while lower demand can lead to discounts and incentives.

- Technological advancements: Advanced safety features, infotainment systems, and other technological advancements add to the cost of manufacturing.

New vs. Used Car Comparison

Comparing a new $25,750 car to a used car with similar features and age reveals potential cost savings and drawbacks. Used cars generally depreciate quickly, offering a lower purchase price but potentially higher maintenance costs. A new car comes with a warranty, reducing the risk of unexpected repairs, but it depreciates significantly in the first few years.

Consumer Considerations and Decision-Making

Making an informed decision when purchasing a new car requires careful consideration of various factors. This section Artikels a checklist to guide consumers through the process.

Checklist for New Car Purchase

Before purchasing a new car, consumers should consider the following:

- Budget and Financing: Determine your budget and explore various financing options to find the best fit.

- Vehicle Needs: Assess your needs and preferences, such as vehicle type, size, features, and fuel efficiency.

- Reliability and Safety: Research vehicle reliability ratings and safety features to ensure you choose a safe and dependable vehicle.

- Dealership Research: Compare prices and incentives from different dealerships before making a purchase.

- Test Drive: Test drive the vehicle to assess its handling, comfort, and overall performance.

- Negotiation: Negotiate the price and terms of the sale with the dealership.

Vehicle Reliability and Safety Research

Researching vehicle reliability and safety ratings is crucial for making an informed decision. Reputable sources for this information include:

- IIHS (Insurance Institute for Highway Safety): Provides crash test ratings and safety feature assessments.

- NHTSA (National Highway Traffic Safety Administration): Offers safety ratings and recalls information.

- Consumer Reports: Provides reliability ratings and reviews based on owner surveys.

Negotiating a Car Price

Negotiating a car price requires preparation and strategy. Key strategies include:

- Researching market prices: Determine the fair market value of the vehicle using online resources.

- Knowing your budget: Set a maximum price you’re willing to pay.

- Being prepared to walk away: If you’re not satisfied with the offer, be willing to walk away and explore other options.

- Focusing on the out-the-door price: Negotiate the total price, including all fees and taxes.

Detailed FAQs

What are the typical insurance costs for a $25,750 car?

Insurance costs vary greatly depending on location, driver profile, and coverage level. Expect to spend several hundred dollars annually.

How long does the car buying process usually take?

The process can range from a few days to several weeks, depending on factors like financing approval and vehicle availability.

What are the common hidden fees associated with buying a new car?

Hidden fees can include dealer prep fees, documentation fees, and extended warranty costs. Carefully review all paperwork before signing.

What is the best time of year to buy a new car?

The end of the month and the end of the quarter are typically good times to negotiate better deals as dealerships aim to meet sales quotas.