Average Car Insurance Price for New Drivers

Factors Affecting Car Insurance Costs for New Drivers: Average Car Insurance Price For New Drivers

Average car insurance price for new drivers – Securing affordable car insurance as a new driver can feel daunting. Numerous factors influence the premiums you’ll pay. Understanding these factors empowers you to make informed decisions and potentially save money.

Factors Influencing Insurance Premiums

Several key elements significantly impact the cost of car insurance for new drivers. The following table provides a detailed breakdown:

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Driving History | Lack of driving experience increases risk perception. | Higher premiums | A new driver with no prior driving record will pay significantly more than an experienced driver with a clean record. |

| Age | Younger drivers are statistically involved in more accidents. | Higher premiums for younger drivers; decreases with age. | A 16-year-old will pay substantially more than a 25-year-old. |

| Vehicle Type | The type of car influences the risk of accidents and repair costs. | Sports cars and high-performance vehicles typically cost more to insure. | Insuring a sports car will be more expensive than insuring a sedan of similar age and condition. |

| Location | Insurance rates vary based on geographic location due to factors like accident rates and crime statistics. | Higher premiums in areas with higher accident rates. | Urban areas often have higher insurance rates than rural areas. |

| Credit Score | Credit history is often used as an indicator of risk. | Lower credit scores can result in higher premiums. | Individuals with poor credit may face higher insurance costs. |

| Driving Record | Accidents, traffic violations, and other incidents negatively impact premiums. | Higher premiums for drivers with a history of accidents or violations. | A speeding ticket or at-fault accident will increase premiums. |

The Role of Driving History

For new drivers, the absence of a driving history presents the biggest challenge. Insurance companies assess risk based on available data. Without a proven track record, insurers perceive a higher risk of accidents, leading to significantly higher premiums. Maintaining a clean driving record once licensed is crucial for reducing future insurance costs.

Vehicle Type and Insurance Costs

The type of vehicle significantly influences insurance premiums. High-performance cars, sports cars, and luxury vehicles are generally more expensive to insure due to higher repair costs, greater potential for theft, and a higher perceived risk of accidents. Sedans and smaller, less powerful vehicles typically have lower insurance premiums.

Age and Insurance Premiums

Insurance premiums are often highest for the youngest drivers and gradually decrease with age. This reflects the statistical correlation between age and accident rates. A visual representation of this trend could be a line graph showing premiums decreasing steadily as age increases from 16 to 25.

Securing affordable car insurance is a major concern for new drivers, often significantly impacting their budget. The cost can vary wildly depending on the vehicle chosen; for example, consider the initial investment when researching, such as the price of a used car like a audi 2016 new car price , which would influence premiums. Ultimately, understanding these upfront costs is crucial for new drivers planning their finances.

Geographic Location and Insurance Rates

Car insurance rates vary significantly across different states and regions. Several factors contribute to these regional differences.

State-to-State Variations in Insurance Costs

- State A: High average insurance costs due to high accident rates and a high cost of living.

- State B: Moderate average insurance costs, reflecting a balance between risk factors and competition among insurers.

- State C: Low average insurance costs due to lower accident rates and a less densely populated area.

Factors Contributing to Regional Differences

Several factors contribute to the variation in insurance rates across different regions. These include the frequency and severity of accidents, the cost of vehicle repairs, the prevalence of vehicle theft, and the level of competition among insurance providers in a given area. State regulations and laws also play a role.

States with Significantly Higher or Lower Insurance Costs

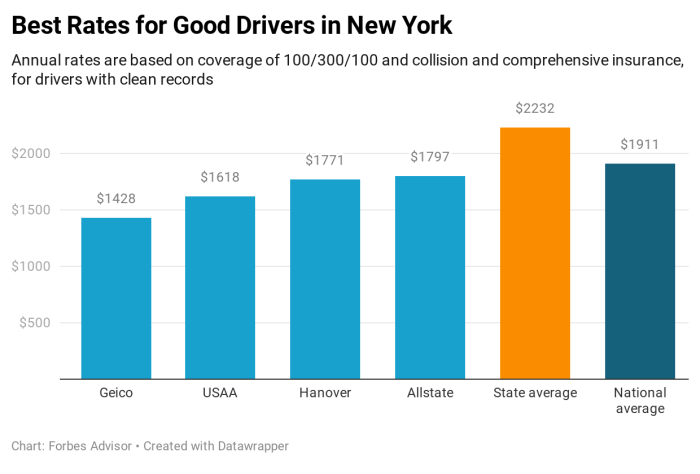

California, for example, often has higher average insurance costs due to high population density, high accident rates, and high repair costs. Conversely, states with lower population densities and fewer accidents may have lower average costs. Specific examples would require referencing current insurance rate data from reputable sources.

Urban vs. Rural Insurance Rates

| Factor | Urban Area | Rural Area |

|---|---|---|

| Accident Rates | Generally higher | Generally lower |

| Population Density | Higher | Lower |

| Insurance Rates | Typically higher | Typically lower |

Types of Car Insurance and Their Costs

Understanding the different types of car insurance coverage is essential for making informed decisions. Each type offers a different level of protection and comes with a corresponding cost.

Types of Car Insurance Coverage

Several types of car insurance coverage are available, each with its own features and costs:

- Liability Insurance: Covers injuries or damages you cause to others. This is usually required by law. Costs vary based on the limits of coverage chosen.

- Collision Insurance: Covers damage to your vehicle in an accident, regardless of fault. This coverage typically has a deductible.

- Comprehensive Insurance: Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage. This also usually includes a deductible.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with an uninsured or underinsured driver.

Minimum Coverage vs. Comprehensive Plans

Source: forbes.com

Minimum coverage typically only includes liability insurance, meeting the legal requirements. Comprehensive plans include liability, collision, and comprehensive coverage, providing broader protection but at a higher cost. The price difference can be substantial, depending on the chosen coverage limits and deductibles.

Impact of Coverage Levels on Premiums

Choosing higher coverage limits and more comprehensive plans will result in higher premiums. However, this increased cost provides greater financial protection in the event of an accident or other covered incident. The choice depends on individual risk tolerance and financial circumstances.

Strategies for Reducing Insurance Costs

Several strategies can help new drivers lower their car insurance premiums. Proactive steps can lead to significant savings over time.

Strategies to Lower Insurance Premiums, Average car insurance price for new drivers

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Complete a defensive driving course: Demonstrates commitment to safe driving.

- Bundle insurance policies: Combine car insurance with other types of insurance (homeowners, renters).

- Consider a higher deductible: A higher deductible reduces your premium but increases your out-of-pocket expenses in case of a claim.

- Shop around and compare quotes: Obtain quotes from multiple insurance providers to find the best rates.

- Maintain good credit: A good credit score can lead to lower insurance premiums.

Impact of Good Driving Records and Safety Courses

Source: wallethacks.com

A clean driving record is a significant factor in determining insurance premiums. Completing a defensive driving course can demonstrate your commitment to safe driving and may result in a discount. Both factors can significantly reduce your insurance costs.

Benefits of Bundling Insurance Policies

Bundling car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to discounts. Insurance companies incentivize customers who bundle their policies, offering lower rates as a reward for loyalty.

Step-by-Step Guide to Comparing Insurance Quotes

- Identify your needs: Determine the level of coverage you require.

- Gather information: Collect personal details (age, driving history, etc.).

- Obtain quotes: Use online comparison tools or contact insurance providers directly.

- Compare coverage and prices: Analyze the quotes to find the best value.

- Review policy details: Carefully examine the policy terms and conditions before purchasing.

Discounts and Savings on Car Insurance

Several discounts can significantly reduce car insurance premiums for new drivers. Taking advantage of these discounts can lead to substantial savings.

Common Car Insurance Discounts

Source: carinsurance.com

| Discount Type | Eligibility Criteria | Percentage Savings (Example) |

|---|---|---|

| Good Student Discount | Maintaining a high GPA | 10-20% |

| Safe Driver Discount | Accident-free driving record | 5-15% |

| Multi-Car Discount | Insuring multiple vehicles with the same provider | 10-25% |

| Telematics Discount | Using a telematics device to monitor driving habits | 5-15% |

| Anti-theft Device Discount | Installing an anti-theft device in your vehicle | 5-10% |

Combining Discounts for Maximum Savings

Many discounts can be combined to achieve even greater savings. For instance, a good student driver with multiple vehicles and an anti-theft device could potentially save a significant percentage on their overall premium.

Potential Savings for a Hypothetical New Driver

A hypothetical new driver who qualifies for a good student discount (15%), a safe driver discount (10%), and a multi-car discount (15%) could potentially save up to 40% on their premium. The actual savings will vary depending on the specific insurer and policy.

Quick FAQs

How long does my insurance rate stay high as a new driver?

Typically, insurance rates for new drivers remain elevated for the first three to five years of driving experience, after which they usually begin to decrease as your driving record improves.

Can I get insurance with a learner’s permit?

Some insurers offer limited coverage for drivers with learner’s permits, but full coverage is usually only available after obtaining a full driver’s license.

What is the difference between liability and collision coverage?

Liability coverage protects others in the event you cause an accident, while collision coverage repairs your vehicle regardless of fault.

Does having a clean driving record significantly impact my premiums?

Yes, maintaining a clean driving record is crucial for obtaining lower insurance rates. Accidents and traffic violations can significantly increase premiums.