Average Car Insurance Price New Driver Costs

Factors Influencing New Driver Insurance Costs: Average Car Insurance Price New Driver

Average car insurance price new driver – The cost of car insurance for new drivers is significantly higher than for experienced drivers. Several factors contribute to this increased premium, reflecting the higher perceived risk associated with less experienced drivers. Understanding these factors is crucial for new drivers to find affordable coverage.

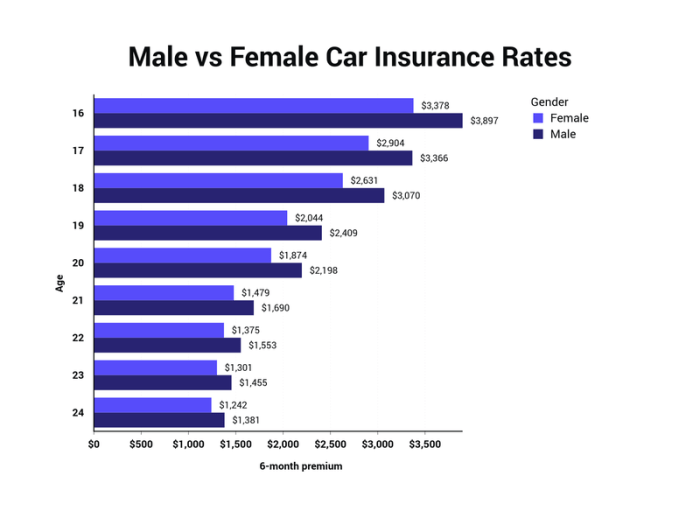

Age

Age is a primary factor influencing insurance costs. Younger drivers, typically under 25, are statistically involved in more accidents than older drivers. Insurance companies consider this increased risk when setting premiums, resulting in higher costs for younger drivers. As drivers gain experience and age, their premiums generally decrease.

Driving Record

A clean driving record is essential for securing lower insurance premiums. Any accidents, traffic violations (such as speeding tickets or reckless driving), or DUI convictions will significantly increase insurance costs. The severity and frequency of incidents directly impact the premium amount. A lack of driving history, common for new drivers, also contributes to higher premiums as insurers lack data to assess risk accurately.

Vehicle Type, Average car insurance price new driver

The type of vehicle a new driver chooses significantly impacts insurance costs. High-performance vehicles, sports cars, and luxury cars are generally more expensive to insure due to their higher repair costs and greater potential for accidents. Sedans and smaller, less powerful vehicles typically have lower insurance premiums.

Location

Geographic location plays a crucial role in determining insurance premiums. Areas with higher accident rates or crime rates tend to have higher insurance costs. Insurers consider the likelihood of theft, vandalism, and accidents when assessing risk in specific locations.

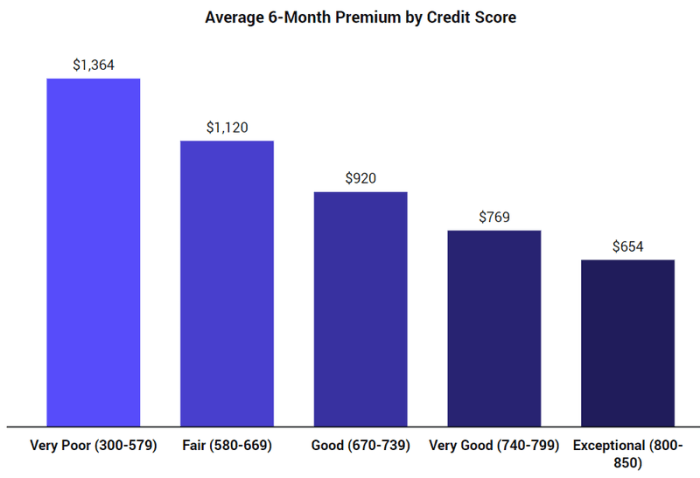

Credit Score

In many states, insurance companies use credit-based insurance scores to assess risk. A lower credit score is often associated with a higher risk of claims, leading to increased premiums. Maintaining a good credit score can help secure lower insurance rates.

Impact of Different Factors on Insurance Premiums

| Factor | High Impact | Medium Impact | Low Impact |

|---|---|---|---|

| Age (under 25) | ✓ | ||

| Driving Record (Accidents/Violations) | ✓ | ||

| Vehicle Type (Sports Car) | ✓ | ||

| Location (High-Risk Area) | ✓ | ||

| Credit Score (Poor) | ✓ | ||

| Driving Record (Clean) | ✓ | ||

| Vehicle Type (Sedan) | ✓ | ||

| Location (Low-Risk Area) | ✓ | ||

| Credit Score (Good) | ✓ | ||

| Gender | ✓ | ||

| Education Level | ✓ |

Telematics Programs

Telematics programs utilize devices or apps that track driving behavior, such as speed, acceleration, braking, and mileage. Data collected through these programs can influence insurance premiums. Safe driving habits, as monitored by telematics, often result in lower premiums, while risky driving behaviors can lead to higher rates. This provides an opportunity for new drivers to demonstrate responsible driving and potentially reduce their costs.

Vehicle Type Comparison

The cost difference between insuring a sports car and a sedan can be substantial. Sports cars, due to their higher repair costs, greater potential for accidents (often due to their performance capabilities), and higher theft risk, typically command much higher insurance premiums. Sedans, being more common and generally less expensive to repair, usually have significantly lower insurance rates.

Insurance Company Pricing Strategies

Insurance companies employ various methods to assess risk and determine premiums for new drivers. Understanding these strategies can help new drivers navigate the insurance market effectively.

Pricing Models

Source: trendnewswatch.com

Insurance companies utilize different pricing models, including usage-based insurance (UBI) which considers driving behavior, and traditional models that primarily rely on demographic and vehicle information. Some insurers also use a combination of these models. Understanding the specific pricing model used by an insurer can help in predicting the potential cost of insurance.

Risk Assessment Methods

Insurers use various methods to assess risk for new drivers, including analyzing their age, driving record (or lack thereof), vehicle type, location, and credit score. They also consider statistical data on accident rates for different demographics and vehicle types. The combination of these factors helps determine the level of risk associated with a new driver and the corresponding premium.

Common Discounts

- Good Student Discount

- Defensive Driving Course Discount

- Multi-Car Discount

- Bundling Home and Auto Insurance

- Telematics Program Discount

Driving History and Premiums

Insurance companies heavily rely on driving history to determine premiums. A lack of driving history for new drivers inherently presents a higher risk. However, a clean driving record, even with limited experience, can positively influence premiums. Conversely, any accidents or violations significantly increase the cost.

Finding Affordable Insurance for New Drivers

Securing affordable car insurance as a new driver requires careful comparison and strategic planning. By understanding the various options and strategies, new drivers can significantly reduce their insurance costs.

Comparing Car Insurance Quotes

Source: thezebra.com

- Obtain quotes from multiple insurance providers.

- Use online comparison tools to streamline the process.

- Compare coverage options and premiums carefully.

- Review policy details thoroughly before making a decision.

- Consider discounts offered by different insurers.

Strategies to Lower Premiums

- Increase deductibles (higher deductible = lower premium).

- Bundle home and auto insurance.

- Maintain a good driving record.

- Enroll in a defensive driving course.

- Consider a telematics program.

Types of Car Insurance Coverage

| Coverage Type | Description | Cost | Typical New Driver Need |

|---|---|---|---|

| Liability | Covers damages to others’ property or injuries to others in an accident you cause. | Low to Moderate | High |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Moderate to High | Moderate |

| Comprehensive | Covers damage to your vehicle from non-collision events (e.g., theft, vandalism, weather). | Moderate to High | Moderate |

The Role of Driving Experience and Safety Features

Driving experience and vehicle safety features play significant roles in determining insurance premiums. Accumulating experience and utilizing advanced safety technologies can lead to lower costs.

Driving Experience and Premiums

As drivers gain experience and build a clean driving record, their insurance premiums generally decrease. Insurance companies view experienced drivers with good records as lower risk. The reduction in premiums typically occurs gradually over several years of safe driving.

Impact of Advanced Driver-Assistance Systems (ADAS)

Vehicles equipped with ADAS features, such as automatic emergency braking, lane departure warning, and adaptive cruise control, often qualify for discounts. These systems help prevent accidents, making the vehicle statistically safer and thus less expensive to insure.

Safe Driving Habits and Premiums

Maintaining safe driving habits is crucial for keeping insurance costs low. Avoiding accidents, traffic violations, and reckless driving significantly reduces the risk profile and results in lower premiums. Consistent safe driving behavior over time demonstrates responsibility and reduces the likelihood of claims.

Maintaining a Good Driving Record

A clean driving record is paramount for low insurance costs. This involves adhering to traffic laws, driving defensively, and avoiding risky behaviors. Regular vehicle maintenance also contributes to safer driving and potentially lower premiums.

Illustrative Examples of Insurance Costs

Source: cloudfront.net

The cost of car insurance for new drivers varies significantly depending on the factors discussed earlier. The following examples illustrate the typical cost ranges and the impact of different factors.

Geographic Cost Variation

Imagine a map of the United States. The cost of insurance is represented by color gradients, with darker shades indicating higher premiums. Coastal cities and densely populated areas show darker shades, reflecting higher accident rates and risk. Rural areas show lighter shades, indicating lower premiums due to lower accident frequency. This visual representation highlights the significant geographic variations in insurance costs.

For instance, a new driver in New York City might pay considerably more than a new driver in a rural area of Montana, even with similar driving records and vehicle types.

Impact of Driving Behaviors

Scenario 1: A new driver with a clean record receives a speeding ticket. Their premium might increase by 15-20%. Scenario 2: A new driver is involved in an at-fault accident. Their premium could increase by 30-50% or more, depending on the severity of the accident and damages. Scenario 3: A new driver maintains a clean driving record for two years.

Securing affordable car insurance as a new driver can be challenging, with premiums often significantly higher than for experienced drivers. The initial cost of the vehicle itself also plays a role; for example, if you’re considering a budget-friendly option like the alto car new model 2019 price in india , this could influence your overall insurance costs.

Ultimately, the total expense depends on factors beyond just the car’s purchase price, impacting the average car insurance price for new drivers.

Their premium will likely decrease by 10-15% as they gain experience and demonstrate responsible driving. These examples illustrate how even a single incident can significantly affect insurance costs, while consistent safe driving leads to lower premiums over time.

Frequently Asked Questions

How long does a speeding ticket affect my insurance?

The impact of a speeding ticket on your insurance can vary depending on the severity of the offense and your insurance company’s policies. It typically remains on your record for three to five years, potentially raising your premiums during that time.

Can I get insurance without a driving history?

Yes, but it will likely be more expensive. Insurers use various factors beyond driving history, such as age, location, and credit score, to assess risk. Expect higher premiums until you build a driving record.

What is a usage-based insurance program?

Usage-based insurance (UBI) programs, also known as telematics programs, track your driving habits using a device installed in your car. Safe driving behaviors often lead to lower premiums.

What is the difference between liability and comprehensive coverage?

Liability coverage pays for damages you cause to others. Comprehensive coverage protects your vehicle from damage caused by events like theft or hail, not accidents.